Short Put Calendar Spread

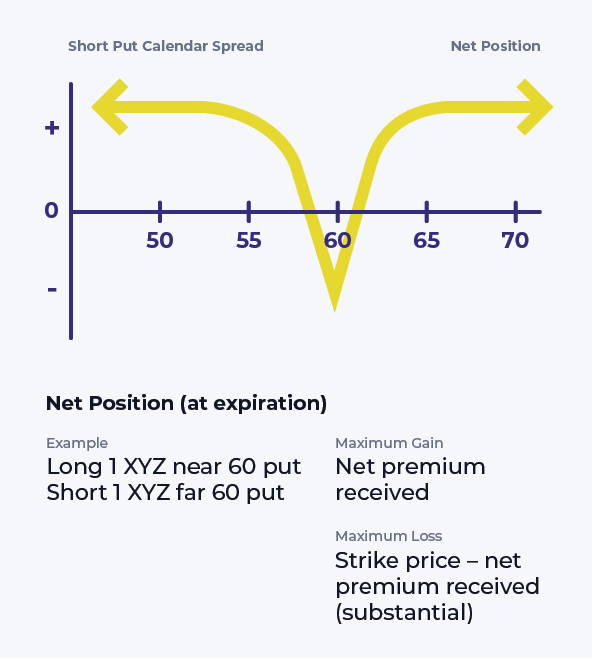

Short Put Calendar Spread - Entering into a calendar spread simply involves buying a call or put option for an expiration month that's further out while simultaneously selling a call or put option. Web a short put calendar spread is another type of spread that uses two different put options. Web buying one put option and selling a second put option with a more distant expiration is an example of a short put calendar spread. Web the complex options trading strategy, known as the put calendar spread, is a type of calendar spread that seizes opportunities. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of a. With a short put calendar spread, the two. Web buying one put option and selling a second put option with a more distant expiration is an example of a short put calendar spread.

Short Put Calendar Spread Options Strategy

Web buying one put option and selling a second put option with a more distant expiration is an example of a short put calendar spread. Web a short put calendar spread is another type of spread that uses two different put options. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call.

Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

Web a short put calendar spread is another type of spread that uses two different put options. Web buying one put option and selling a second put option with a more distant expiration is an example of a short put calendar spread. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call.

Short Calendar Spread Option Strategy Dasie Emmalyn

Web buying one put option and selling a second put option with a more distant expiration is an example of a short put calendar spread. Web the complex options trading strategy, known as the put calendar spread, is a type of calendar spread that seizes opportunities. With a short put calendar spread, the two. Web a short put calendar spread.

Short Put Calendar Spread Printable Calendars AT A GLANCE

Web buying one put option and selling a second put option with a more distant expiration is an example of a short put calendar spread. Web buying one put option and selling a second put option with a more distant expiration is an example of a short put calendar spread. With a short put calendar spread, the two. Web a.

Short Put Calendar Short put calendar Spread Reverse Calendar

Web buying one put option and selling a second put option with a more distant expiration is an example of a short put calendar spread. Web buying one put option and selling a second put option with a more distant expiration is an example of a short put calendar spread. Web a long calendar spread—often referred to as a time.

Calendar Put Spread Options Edge

Entering into a calendar spread simply involves buying a call or put option for an expiration month that's further out while simultaneously selling a call or put option. With a short put calendar spread, the two. Web a short put calendar spread is another type of spread that uses two different put options. Web buying one put option and selling.

Advanced options strategies (Level 3) Robinhood

Web buying one put option and selling a second put option with a more distant expiration is an example of a short put calendar spread. Web buying one put option and selling a second put option with a more distant expiration is an example of a short put calendar spread. Web a short put calendar spread is another type of.

Futures Calendar Spread Trading Strategies Gizela Miriam

Web the complex options trading strategy, known as the put calendar spread, is a type of calendar spread that seizes opportunities. Web buying one put option and selling a second put option with a more distant expiration is an example of a short put calendar spread. Web buying one put option and selling a second put option with a more.

Short Calendar Put Spread Staci Elladine

Web a short put calendar spread is another type of spread that uses two different put options. Web the complex options trading strategy, known as the put calendar spread, is a type of calendar spread that seizes opportunities. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying.

How to Create a Credit Spread with the Short Calendar Put Spread YouTube

With a short put calendar spread, the two. Entering into a calendar spread simply involves buying a call or put option for an expiration month that's further out while simultaneously selling a call or put option. Web a short put calendar spread is another type of spread that uses two different put options. Web buying one put option and selling.

Entering into a calendar spread simply involves buying a call or put option for an expiration month that's further out while simultaneously selling a call or put option. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of a. Web a short put calendar spread is another type of spread that uses two different put options. Web buying one put option and selling a second put option with a more distant expiration is an example of a short put calendar spread. Web the complex options trading strategy, known as the put calendar spread, is a type of calendar spread that seizes opportunities. Web buying one put option and selling a second put option with a more distant expiration is an example of a short put calendar spread. With a short put calendar spread, the two.

With A Short Put Calendar Spread, The Two.

Web buying one put option and selling a second put option with a more distant expiration is an example of a short put calendar spread. Web a short put calendar spread is another type of spread that uses two different put options. Web the complex options trading strategy, known as the put calendar spread, is a type of calendar spread that seizes opportunities. Entering into a calendar spread simply involves buying a call or put option for an expiration month that's further out while simultaneously selling a call or put option.

Web Buying One Put Option And Selling A Second Put Option With A More Distant Expiration Is An Example Of A Short Put Calendar Spread.

Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of a.

![Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://i2.wp.com/assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/6019b83133ac2d32ef084fa5_TsbQgZxQ0e-zKJ9h6Fa7azNlnvn0zH-UBlX3l7hriHll2es1fvyFY5N-nOyM1153MJ4wXLNIhH4zanFkJQB0mpqs81lwEBIvqa7IZQRPWXZY1i3J7vV3BpTIL3v5nCyqn-CEbq2U.png)